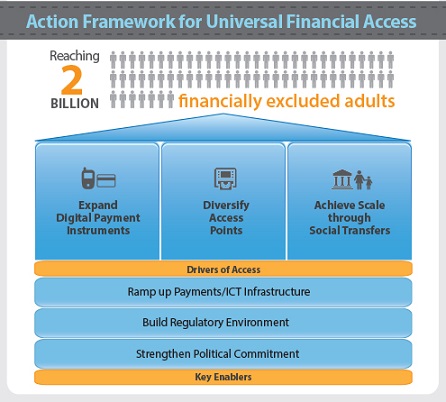

The World Bank Group (WBG) has identified country-level opportunities for opening up access to transaction accounts through the Universal Financial Access framework and data model (note).

The UFA2020 initiative is focusing on 25 countries where 73% of all financially excluded people live: Bangladesh, Brazil, China, Colombia, Cote d'Ivoire, DRC, Egypt, Ethiopia, India, Indonesia, Kenya, Mexico, Morocco, Mozambique, Myanmar, Nigeria, Pakistan, Peru, Philippines, Rwanda, South Africa, Vietnam, Tanzania, Turkey, and Zambia.

However, the WBG’s financial inclusion work is not limited to these countries. Based on estimates and key interventions identified in the UFA framework, countries worldwide have the opportunity to enable access to a transaction account and other financial services to:

- 1.3 billion adults by opening up the regulatory environment and market to reach financially active, unbanked adults who currently save, remit or pay bills in cash.

- 167 million adults by digitizing government (G2P) payments provided to unbanked adults and depositing them directly into transaction accounts.

- 802 million adults by developing and implementing national financial inclusion strategies (NFIS) to coordinate financial inclusion efforts and increase the number of banked adults over time.

These opportunities are not exhaustive, and they overlap. Key enablers like financial capability, adequate consumer protection and/or financial infrastructure are needed to foster the full reach to the unbanked.

* New Payment Aspects of Financial Inclusion (PAFI) guidance has been launched with an updated framework that provides guidance to regulators and policy makers.